When I sit down with Calgary luxury homeowners, one of the most common blind spots I see is this: everyone focuses on the sale price, but far fewer think about the tax bill that comes after.

In 2025, selling a $1M+ home in Calgary — whether it’s an Aspen Woods estate, a Mount Royal heritage property, or an Altadore infill — carries very specific tax implications. Some are municipal, some are federal, and all of them can impact how much you actually walk away with after closing.

Misunderstanding these obligations can create unexpected financial burdens, and for high-value transactions, even small errors can mean tens of thousands of dollars. That is why I have taken some time to dig deep into both municipal property taxes and federal capital gains, providing the detailed explanations you need before selling in the Calgary real estate market.

How Calgary’s Property Tax System Works

Calgary’s property tax system can feel technical, but it is crucial for luxury homeowners to understand because the higher the property value, the bigger the impact. Property taxes are the City’s largest revenue source, funding services like police, fire, transit, libraries, parks, and road infrastructure.

The tax you pay is based on two parts: the City’s annual mill rate (a dollar amount applied per $1,000 of assessed value) and your home’s assessed market value, which is determined by the City’s Assessment unit.

Assessments reflect your home’s estimated value on July 1 of the previous year and its physical state on December 31. This means your 2025 tax bill is based on how your property looked and what the market was doing in mid-to-late 2024. If luxury sales surged last year, you may see that reflected even if the market cools in 2025.

For example, if your home in Aspen Woods sold in May 2025 for $2.1M, but the July 1, 2024 assessment pegged it at $2.4M, your property tax will still be calculated using the higher assessed value. This disconnect often confuses homeowners, especially those who expect their tax bill to track directly with their sale price. In practice, the City’s process lags behind the real-time market, and sellers need to anticipate this.

Property taxes are due by June 30 each year, unless you are enrolled in the Tax Instalment Payment Plan (TIPP). For luxury sellers, this date is critical. If you close a sale after June 30 and you have not prepaid, you may owe penalties or risk complications at closing.

Lawyers always settle tax adjustments, but if you miss payments, penalties can reduce your net proceeds or force you to credit the buyer more than expected. A penalty of 7% on a $10,000 luxury tax bill means $700 lost instantly.

What Luxury Sellers Must Know in 2025

Luxury sellers in Calgary face a few distinct situations that average homeowners may not encounter. First, there is the property tax adjustment at closing. If you sell your Springbank Hill estate in July, you are responsible for property taxes from January 1 to possession day. If you prepaid the entire year, the buyer reimburses you for their share covering July through December. If you haven’t paid yet, your lawyer will deduct what you owe from the sale proceeds. The larger the bill, the more critical accurate adjustments become.

Next, capital gains considerations. If the home is your primary residence, you qualify for the principal residence exemption and avoid capital gains tax altogether. But if it is an investment property, a second home, or a rental, you may owe substantial taxes. For example, selling a rental condo in Eau Claire purchased for $1.2M and sold for $1.8M produces a $600,000 gain. Half of that gain ($300,000) is taxable, and at Alberta’s top bracket (~48%), you may owe $144,000. That is a huge chunk of profit lost if you are not prepared.

Another issue is assessment surprises. Because assessments lag by six months or more, they often do not reflect current market realities. If luxury prices surged in fall 2024, your 2025 bill will rise even if, by spring 2025 the market cools. Sellers in Altadore sometimes see their assessments rise by hundreds of thousands during periods of infill booms, even when the demand slows before they list. It pays to check your assessment early and appeal if necessary.

Finally, high-value exposure means small percentage changes in tax rates have outsized effects. A $2M estate can see annual municipal taxes of around $7,740 before education tax. If Council raises the rate even slightly, you may pay an extra $500 or more, while a median homeowner might see just a $50 increase.

How Much Is Property Tax in Calgary?

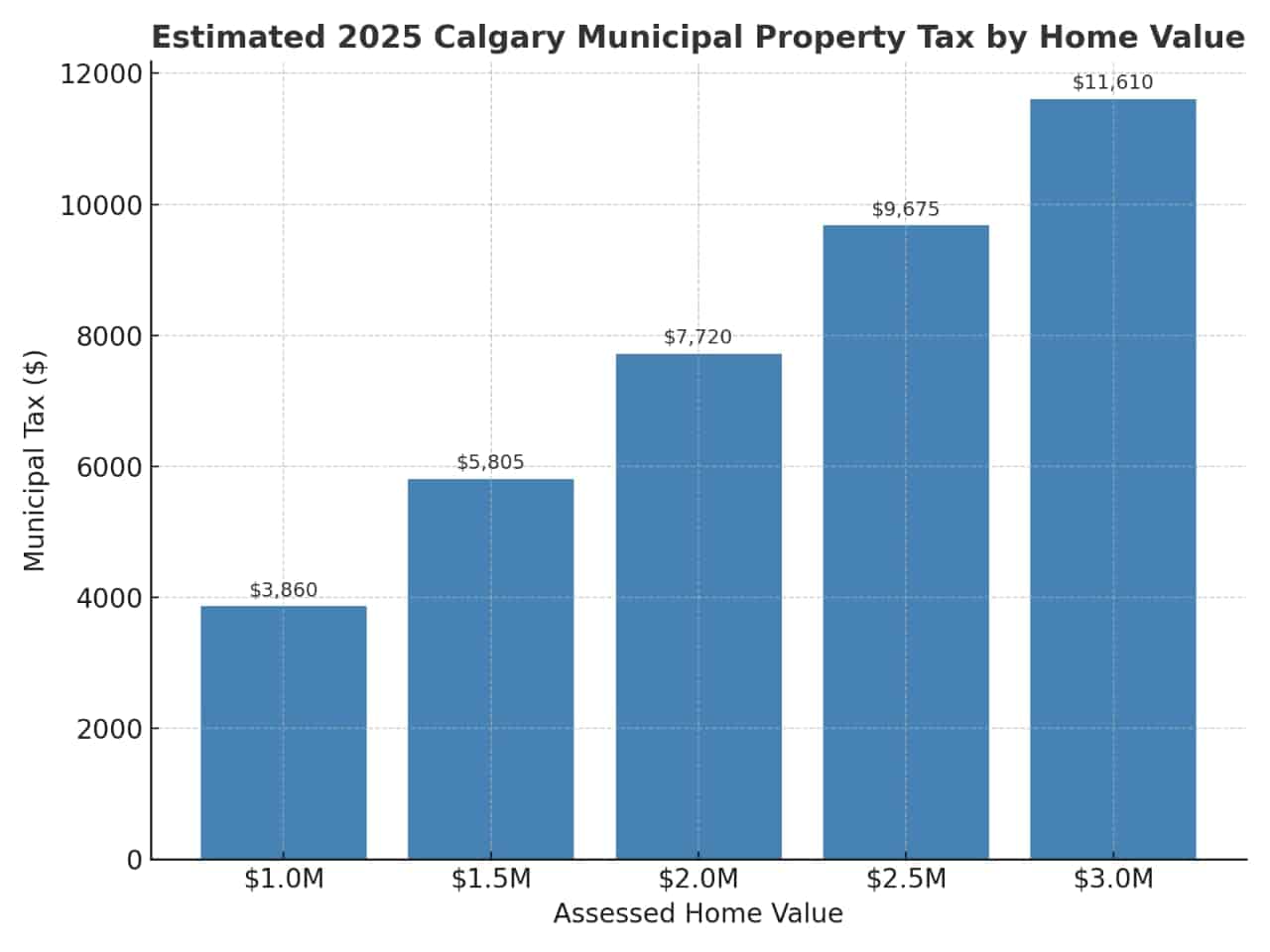

Property tax bills vary based on assessed value, but here is how it plays out in 2025:

- A median single-family home assessed at $697,000 pays roughly $2,698 in municipal taxes.

- A luxury property valued at $1.5M pays around $5,805 in municipal taxes.

- A mansion assessed at $2.5M pays close to $9,675 in municipal taxes.

Add to that the provincial education tax, which is significant and often overlooked, and the totals rise even further. For instance, a $2.5M luxury property may pay well over $12,000 annually once education taxes are included. This is why planning matters. Sellers who list in May, close in July, and have not budgeted for this obligation can feel blindsided when they realize their lawyer is deducting several thousand dollars from their proceeds.

What Is Capital Gains Tax?

Capital gains tax applies when you sell a property or asset for more than you originally paid, adjusted for eligible costs like renovations and legal fees. In Canada, only 50% of that gain is taxable, but when we are talking about luxury properties with million-dollar increases in value, the numbers quickly become significant.

What Counts as Capital Property?

Capital property includes real estate beyond your primary residence, such as vacation homes in Canmore, rental units in Eau Claire, or investment properties in Altadore. It also covers stocks, bonds, and collectibles if they are held for investment purposes.

What Doesn’t Count as Capital Property?

Your principal residence is excluded if you claim the exemption, meaning gains are not taxable. Everyday personal-use items such as your car or home furnishings are also excluded, unless they are part of an investment strategy (such as collectible cars).

How Capital Gains Tax Works in Canada

The inclusion rate in Canada is 50%, meaning only half of your gain is taxable. The actual tax you owe depends on your marginal tax rate. For Calgary luxury homeowners, this can be as high as 48% in 2025. For instance, selling a Mount Royal estate purchased for $2M and sold for $3M results in a $1M gain. Half ($500,000) is taxable. At the top bracket, you could owe $240,000 in taxes. Even at lower brackets, the amounts are large enough to reshape financial planning.

How to Avoid Capital Gains Tax in Canada

- Claim the principal residence exemption if eligible.

- Structure ownership with spouses to distribute taxable gains.

- Track all renovations to increase your adjusted cost base. For example, a $200,000 kitchen and landscaping project adds to your cost base, reducing your gain.

- Sell in a year where your income is otherwise lower, reducing the tax bracket applied to your gain.

How Does the Seller’s Tax Bracket Affect Capital Gains?

If you are in the highest bracket, your taxable gain is taxed at close to 48% in Alberta. If you are in a lower bracket, your effective tax rate will be much less. Timing matters — a retired seller with less income in the year of sale may pay far less than a professional still earning high annual income.

Example of Taxes on the Same Gain Across Provinces

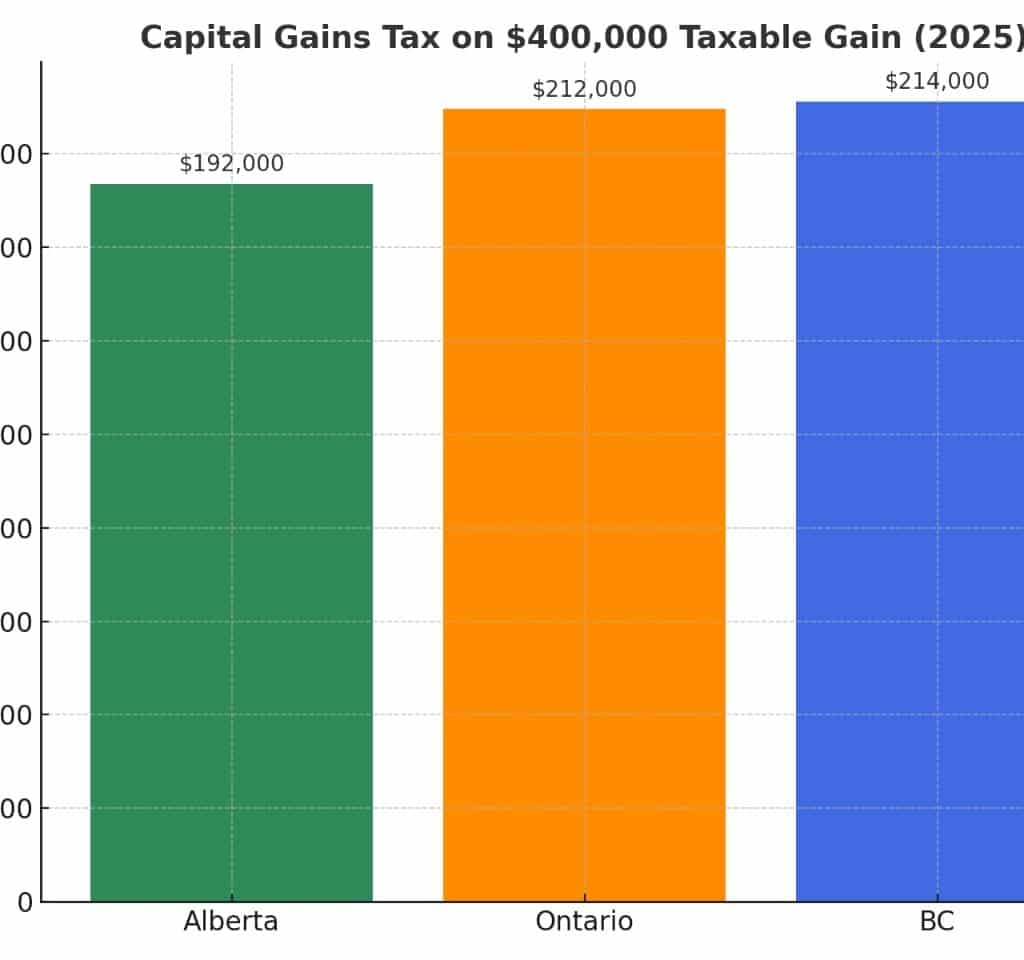

If you realized a $400,000 taxable gain:

- In Alberta (top bracket ~48%), you owe ~$192,000.

- In Ontario (top bracket ~53%), you owe ~$212,000.

- In BC (top bracket ~53.5%), you owe ~$214,000.

This demonstrates Alberta’s relative advantage. A Calgary luxury seller keeps significantly more of their proceeds than their counterpart in Toronto or Vancouver.

Special Exemptions and Strategies

Special Exemptions That Could Save You Thousands

The principal residence exemption is the most powerful tool. If you designate your property as your primary residence for all the years you owned it, you pay no capital gains tax on the sale. In estate planning, rollover provisions allow transfers to spouses or certain trusts without triggering immediate gains. There are also deferral programs in rare circumstances, though they are limited and not commonly used in Calgary luxury transactions.

Simple Strategies to Reduce Capital Gains Tax

One of the simplest is to track every renovation expense. If you spent $300,000 over the years on additions, landscaping, or major upgrades, these costs increase your cost base, reducing your taxable gain. Another is to consider splitting ownership with a spouse, distributing the gain across two individuals and potentially lowering overall tax owed. Timing also matters: if you expect a year with lower income — for instance, after retirement or a sabbatical — that could be the ideal year to sell. Finally, offsetting with losses from other investments, like stocks, can significantly reduce your tax burden.

Common Mistakes That Cost Money

Luxury sellers often miss deductions because they failed to keep receipts for renovations. Others wrongly assume a second property qualifies for the principal residence exemption, leading to unexpected CRA bills. Another mistake is misreporting the sale date, which can affect both tax years and applicable rates. And the biggest error: ignoring CRA deadlines. A late or incorrect filing may trigger penalties and interest, which at luxury levels can mean thousands in additional costs.

Staying on the CRA’s Good Side

The Canada Revenue Agency expects luxury sellers to declare all sales, even if exempt. You must report the sale of your principal residence on your tax return, even if no tax is owed. CRA audits are not uncommon in high-value transactions, so keeping records for at least six years is critical. Ensure you declare all improvements, report sale proceeds accurately, and consult a tax professional experienced in Calgary luxury real estate. A Mount Royal estate owner who underreported their sale by $200,000 could face not only back taxes but also penalties that quickly add up.

Conclusion & CTA

Selling your Calgary luxury home in 2025 isn’t just about finding the right buyer — it’s about making sure you understand the full financial picture, including property taxes, assessment timing, and potential capital gains. Missteps here can cost thousands. The stakes are higher in the luxury market, where small errors scale into huge financial consequences.

As a Calgary luxury specialist, I guide clients through every detail, from staging and pricing to explaining what the tax bill means for your bottom line. I work with trusted accountants, lawyers, and advisors to ensure nothing slips through the cracks.

📞 If you’re thinking about selling in 2025, reach out today to ensure your strategy covers both maximum value and smart tax planning.

👉 Contact Spencer Rivers – Luxury Homes Calgary

FAQs for Calgary Luxury Owners

Q1: How to pay property tax in Calgary?

Through your bank’s online bill payment, in person at City counters, or by enrolling in the monthly TIPP program.

Q2: When are Calgary property taxes due?

June 30th, unless you’re on TIPP. Late payments incur penalties.

Q3: How much is Property tax in Calgary?

Median 2025 bill = ~$2,698. Luxury homes scale up proportionately. Use the City of Calgary Property Tax Calculator for estimates.

Q4: What happens to my property tax bill when I sell?

Lawyers adjust it at closing. Buyers reimburse sellers for prepaid taxes.

Q5: Will I pay capital gains tax when I sell my Calgary luxury home?

Not if it’s your primary residence. Yes, if it’s a rental, second home, or investment. The taxable portion is 50% of your gain.

Q6: How does Alberta compare to other provinces for capital gains tax?

Alberta’s top tax rate (~48%) is lower than Ontario’s and BC’s, meaning sellers often keep more in Calgary.

Q7: Can I reduce or avoid paying capital gains?

Yes — by claiming the principal residence exemption, planning timing, and tracking eligible expenses.

Q8: What happens if I underreport or misfile my sales with CRA?

You may face penalties, back taxes, and interest. Always report sales properly, even if no tax is due.