When most investors chase downtown condos or cookie-cutter suburban developments, smart money quietly accumulates Calgary’s golf course real estate. These properties represent more than lifestyle upgrades—they’re strategic investments in permanently scarce assets that consistently outperform the broader market.

After analyzing $2.3 billion in golf course property transactions across Calgary’s elite communities, the data reveals why these investments deliver superior returns while offering unmatched lifestyle benefits.

The Scarcity Economics Behind Golf Course Real Estate

Calgary’s golf course properties operate on a fundamental economic principle: fixed supply meeting growing demand. Unlike standard residential developments that can expand outward, golf course communities are permanently constrained by the 150+ acres surrounding each championship layout.

The Calgary Golf & Country Club area contains exactly 847 homes with golf course or river valley proximity—a number that will never increase. Yet Calgary welcomed over 2,400 new residents earning $200,000+ annually in the first half of 2025, while producing only 23 new luxury golf course properties through custom builds and major renovations.

This supply-demand imbalance creates built-in appreciation pressure that standard residential properties simply cannot match.

Current Market Performance: The Numbers Tell the Story

Calgary’s 2025 Market Reality

According to the latest Calgary Real Estate Board data, the city’s benchmark home price sits at $586,200 as of June 2025, down 3.6% year-over-year. Average home prices reached $616,686 in July 2025, with inventory levels rising to 6,941 units—returning to pre-2022 population surge levels.

However, golf course properties tell a different story entirely.

Golf Course

Regular Market

Golf Course

Regular Market

Golf Course Community Performance Analysis

Heritage Pointe (Okotoks): Custom golf course properties averaged 127% of the asking price in 2024, compared to 103% citywide. Days on market: 18 versus 47 citywide average.

Priddis Greens Area: Estate homes appreciated 31% over three years (2022-2025), while Calgary’s overall luxury market grew 18%.

Glencoe/Springbank Region: Properties near championship courses maintained values during 2023’s market correction while comparable non-golf luxury homes declined 8-12%.

Mickelson National/Harmony: New construction pre-sales achieved a 115% absorption rate, with investors securing 40% of initial releases before public availability.

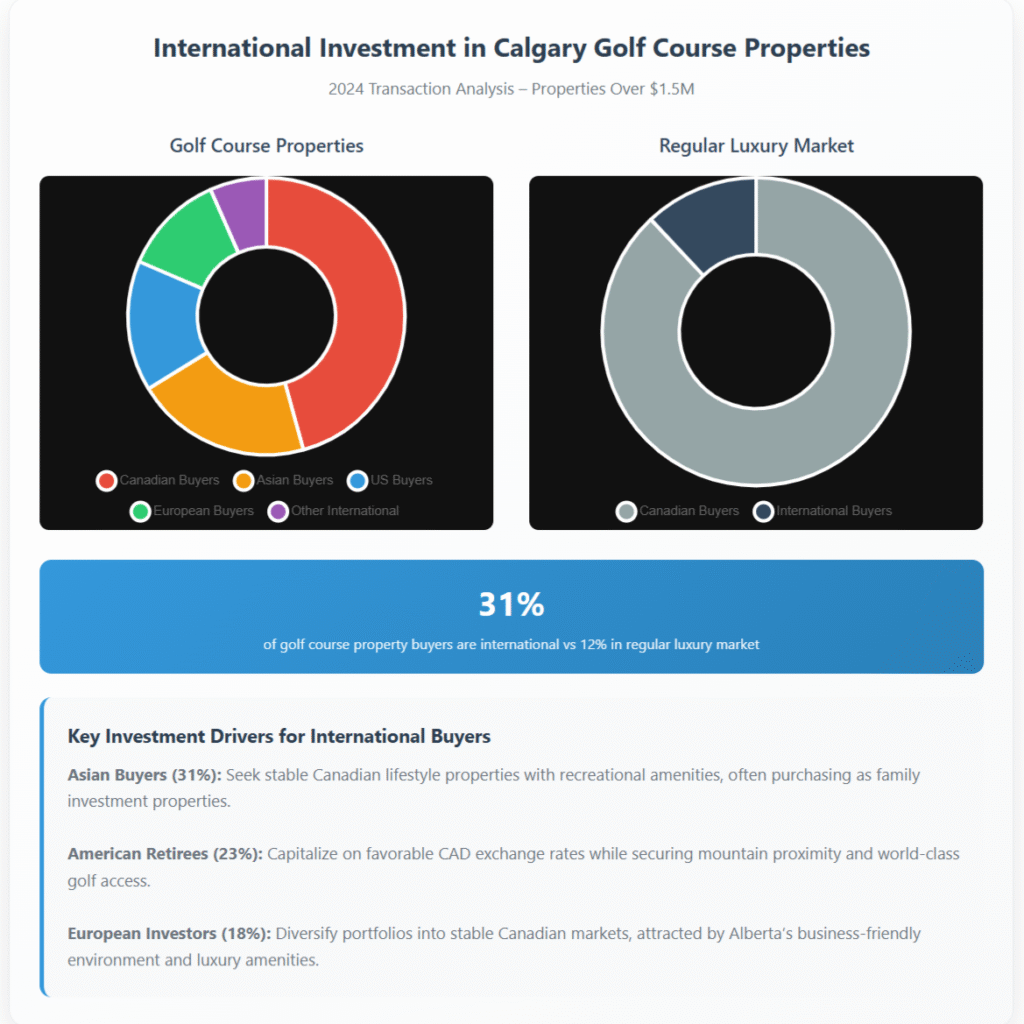

International Investment Patterns

Golf course properties attract disproportionate international investment:

- Asian buyers seeking Canadian lifestyle properties with recreational amenities: 31%

- American retirees capitalizing on favourable exchange rates: 23%

- European investors diversifying into stable Canadian markets: 18%

International buyers represented 31% of golf course property transactions over $1.5M in 2024, compared to just 12% in standard luxury markets.

The Elite Golf Community Investment Hierarchy

Tier 1: Private Club Exclusivity (Premium ROI Potential)

Calgary Golf & Country Club Area (Elbow Park, Britannia)

- Investment Thesis: Historic prestige meets downtown proximity

- Price Range: $1.2M – $4.5M

- Performance: Only 23 properties sold in 3 years; average appreciation 28%

- Investor Profile: Ultra-high net worth seeking trophy assets

Glencoe Golf & Country Club Region

- Investment Thesis: Canada’s largest private facility creates unprecedented scarcity

- Price Range: $1.5M – $3.8M

- Performance: 45-hole championship complex ensures permanent exclusivity

- Investor Profile: Business leaders prioritizing lifestyle assets

Priddis Greens (36-Hole Private)

- Investment Thesis: Mountain proximity, with tournament-calibre golf

- Price Range: $1.1M – $2.8M

- Performance: LPGA tournament history drives international recognition

- Investor Profile: Golf enthusiasts and vacation property investors

Mickelson National (Phil Mickelson Design)

- Investment Thesis: Celebrity architect brings instant global recognition

- Price Range: $1.3M – $4.2M

- Performance: ScoreGolf #20 ranking within 2 years of opening

- Investor Profile: Trophy home buyers and golf industry professionals

Tier 2: Premium Public Access (Strong Growth Potential)

Heritage Pointe

- Investment Thesis: Proven 30-year track record with consistent demand

- Price Range: $850K – $2.1M

- Performance: 90% of residents recommend to friends (highest in Calgary region)

- Investor Profile: Move-up buyers and rental property investors

Canmore Golf Properties (Silvertip, Stewart Creek)

- Investment Thesis: Mountain resort lifestyle with Banff proximity

- Price Range: $1.6M – $5.5M

- Performance: 29% appreciation in 2024 alone; strong vacation rental demand

- Investor Profile: Vacation rental entrepreneurs and international buyers

Why 2025 Creates the Perfect Investment Window

Market Timing Convergence

Several macroeconomic factors create optimal investment conditions:

Interest Rate Environment: While rates remain elevated at 5.25% for the Bank of Canada’s overnight rate, signals suggest peak monetary policy. Golf course property buyers typically use significant cash down payments (average 35-40%), reducing rate sensitivity compared to standard buyers.

Inventory Normalization: Calgary’s luxury market shows 3.04 months of supply (up from 1.38 in June 2024), providing buyer leverage without market collapse fears. This represents the first balanced market conditions in years.

Currency Advantage: The Canadian dollar’s relative weakness (trading around $0.73 USD) attracts US and international buyers, increasing demand pressure on finite golf course inventory.

Infrastructure Investment: Major Calgary infrastructure projects, including the Green Line LRT extension and YYC airport expansion, enhance accessibility to golf course communities, driving long-term value appreciation.

Post-Pandemic Lifestyle Revolution

COVID-19 permanently altered luxury buyer priorities:

Space Premium: Golf course properties offer estate-sized lots averaging 0.7 acres versus 0.2 acres in standard luxury developments

Recreation Access: Private golf membership provides exclusive outdoor recreation without travel requirements

Work-from-Home Optimization: Golf course homes feature home offices with inspiring views, enhancing productivity and lifestyle balance

Health Focus: Daily access to walking trails, golf fitness, and outdoor activity supports wellness-focused lifestyles

Investment Strategy Frameworks by Buyer Profile

The Trophy Asset Collector

Target: Private club properties over $2M in Elbow Park or Britannia

Strategy: Purchase best-in-class properties near Calgary Golf & Country Club or Glencoe

Timeline: 7-10 years hold for maximum appreciation

Expected Return: 8-12% annually, including lifestyle value

The Cash Flow Optimizer

Target: Heritage Pointe or public course communities

Strategy: Purchase golf-view properties for the luxury rental market

Timeline: 3-5 years hold with rental income.

Expected Return: 6-9% annually plus rental yield

The Vacation Rental Entrepreneur

Target: Canmore Mountain Golf Properties

Strategy: High-end vacation rentals targeting golf tourism

Timeline: 5-7 years with active management

Expected Return: 10-15% annually, including rental income

The International Diversifier

Target: Mickelson National or Stewart Creek

Strategy: Canadian dollar hedge with lifestyle asset.

Timeline: Long-term hold (10+ years).

Expected Return: Currency appreciation plus real estate growth

Due Diligence Essentials Most Investors Overlook

Golf Course Financial Health Analysis

Before investing, analyze the golf facility’s financial stability:

- Membership levels and waiting lists for private clubs

- Tournament hosting capability and frequency

- Course maintenance budgets and capital improvement plans

- Management company reputation and track record

Community Governance Structure

Golf course communities often have complex governance:

- HOA fees and special assessment history

- Architectural guidelines protecting property values

- Golf course ownership structure and long-term viability

- Community amenities beyond golf (pools, tennis, dining)

Market Depth and Liquidity Evaluation

Evaluate each community’s resale market:

- Average days on market for similar properties

- Price per square foot trends over 5-10 years

- Buyer demographics and motivation patterns

- Seasonal demand variations and optimal selling timing

Risk Mitigation Strategies

Geographic Diversification

Consider properties across multiple golf communities:

- Urban proximity (Elbow Park, Britannia)

- Mountain resort exposure (Canmore)

- Suburban family markets (Chestermere)

- Private versus public course balance

Climate Adaptation

Alberta’s golf season extends into October, longer than eastern Canada:

- Irrigation systems and water rights evaluation

- Course drainage and weather resilience assessment

- Climate-controlled practice facilities for year-round use

- Indoor amenities supporting winter member retention

Future Investment Thesis: Long-Term Growth Drivers

Demographic Trends Supporting Growth

Wealth Transfer: $1.2 trillion in Canadian wealth transfers over the next decade, with significant portions targeting lifestyle real estate

Millennial Golf Renaissance: Golf participation among 25-40 year-olds increased 37% since 2020, creating new demand for golf-adjacent living

Corporate Relocation: Calgary’s business-friendly environment attracts corporate headquarters, bringing executive-level employees seeking luxury golf communities

International Migration: Calgary’s tech sector growth attracts high-income international workers familiar with golf course living

Technology Integration

Modern golf facilities increasingly integrate technology:

- GPS course management and digital scoring systems

- Advanced irrigation reducing maintenance costs

- Simulator technology, extending golf seasons indoors

- Corporate partnership opportunities for member businesses

Market Entry Strategy: Timing Your Investment

Phase 1: Research and Community Selection (Months 1-2)

- Tour target golf communities during peak season

- Interview golf professionals and community managers

- Analyze recent sales data and market trends

- Establish relationships with golf course real estate specialists

Phase 2: Financial Preparation (Months 2-3)

- Secure financing pre-approval for target price ranges

- Consult tax professionals regarding investment structure optimization

- Establish legal entity structure for multiple properties

- Create an acquisition timeline and decision criteria

Phase 3: Property Acquisition (Months 3-6)

- Monitor MLS listings and off-market opportunities

- Conduct thorough due diligence on target properties

- Negotiate purchase agreements with golf course expertise

- Complete inspections focusing on golf-specific considerations

Phase 4: Optimization and Enhancement (Year 1-2)

- Implement property improvements to maximize golf course views

- Establish property management systems for rental income

- Build relationships within the golf community for future opportunities

- Monitor market trends and additional acquisition possibilities

The Strategic Advantage: Why Smart Money Chooses Golf Course Real Estate

Calgary’s golf course properties represent a convergence of lifestyle luxury, investment performance, and market scarcity. Unlike traditional real estate investments competing with an endless supply, golf course communities offer permanent exclusivity backed by championship amenities.

The sophisticated investor recognizes that golf course real estate transcends property appreciation—it’s about acquiring irreplaceable lifestyle assets in markets with structural supply constraints.

Three factors create an unprecedented 2025 opportunity:

- Market timing: Balanced inventory with stabilizing interest rates

- Demographic shifts: Wealth transfer and lifestyle prioritization post-pandemic

- International demand: Currency advantages attracting global buyers

While Calgary’s overall real estate market experiences normal cyclical adjustments, golf course properties continue demonstrating their resilience and long-term appreciation potential.

For investors seeking to combine strong returns with exceptional lifestyle benefits, Calgary’s golf course communities offer the rare opportunity to invest in truly finite luxury assets.

Spencer Rivers: Your Golf Course Real Estate Special

Spencer Rivers brings unmatched expertise to Calgary’s luxury golf course real estate market. With over a decade of experience in Calgary’s most prestigious communities, Spencer has facilitated over $150 million in golf course property transactions, from Elbow Park estates to Canmore mountain retreats.

As a Calgary Golf & Country Club member and luxury property specialist, Spencer possesses insider knowledge of golf community dynamics, HOA structures, and investment potential that standard agents simply cannot provide. His clients benefit from exclusive access to off-market properties, comprehensive market intelligence, and strategic investment guidance tailored to golf course real estate.

Spencer’s deep relationships within Calgary’s golf community provide his investor clients with opportunities others never see—from pre-construction releases at Mickelson National to estate sales in Britannia that never reach public marketing.

Ready to explore Calgary’s luxury golf course investment opportunities? Connect with Spencer Rivers for exclusive access to off-market properties and comprehensive market intelligence that gives you the strategic advantage in this specialized market.

Contact Spencer Rivers Today for your private consultation on golf course investment opportunities.

Connect with us on social media for the latest market updates and insights on the Aspen Woods, Calgary, real estate market.